SO WHAT IS THE APPETITE TO EXTERNAL FUNDING FOR SMES

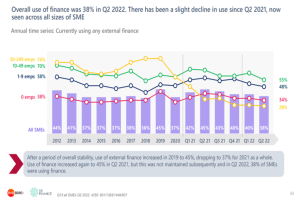

COVID-19 has brought into sharp focus the variety and range of existing and new finance options available to small businesses.

Attitudes to external finance were well understood before COVID-19 – have they changed?

More importantly, have your attitudes changed?

Small businesses with less than 50 employees employ 12.9m people (48% of total private sector employment) and account for 36% of private sector turnover. The Small Business Price Index (SBPI) provides an indication of the cost of doing business among this critical group of firms.

The SBPI suggests that small business costs increased more rapidly in 2022q2 than in any period since the start of the SBRI series in 2008. Small business costs rose 4.4% in 2022q2 alone, following a 4.3% increase in 2022q1. Both represent a higher rate of small business cost inflation than at any period since 2008.

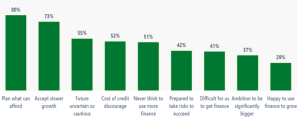

Attitudinally, SMEs were almost 3 times as likely to make plans based on what they can afford (80%) as they were to be happy to borrow to help the business grow (29%).

All attitudes to finance YEQ4 2019 = % agree

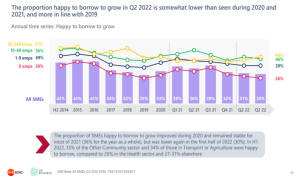

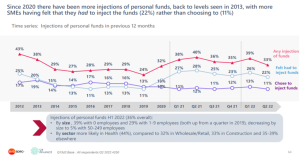

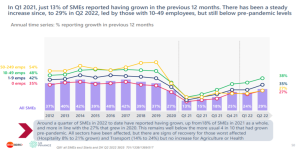

Confidence in the SME market for owners to borrow to fund their business growth has changed dramatically and now owners are not planning for survival but for growth and to finally thrive again but not at all costs. Owners are becoming more driven by data and affordability of debt which may hamper growth.

Other news